Every day, costs keep rising, savings lose strength, and many feel they have less control over their finances. Bitwala gives you tools to protect and grow what you worked for, with Bitcoin and simple investing available in one secure app.

Inflation is not only a concern for bankers. It reduces the value of salaries and savings. When prices rise faster than income, money loses its purchasing power. Understanding why this happens helps you make more intelligent choices.

What is inflation?

Inflation means your money loses purchasing power over time. It can be hard to spot, because the money looks the same, yet it buys less than it did a year ago.

The most common way to measure inflation is the consumer price index. It compares the purchasing power of a currency, for example, the euro or the dollar, with the average prices of consumer goods. If you can buy less with a currency than in the previous year, its purchasing power has fallen.

Inflation has cooled from the peaks seen in 2022, yet the effect remains. In Germany the rate sits near 2 percent in 2025, the United Kingdom is around 3 percent, and the United States is close to 3 percent as well.

Prices are no longer rising as fast as before, but many goods and services remain far more expensive than they were just a few years ago. This means your income and savings still need to work harder to keep up.

High prices are the new normal

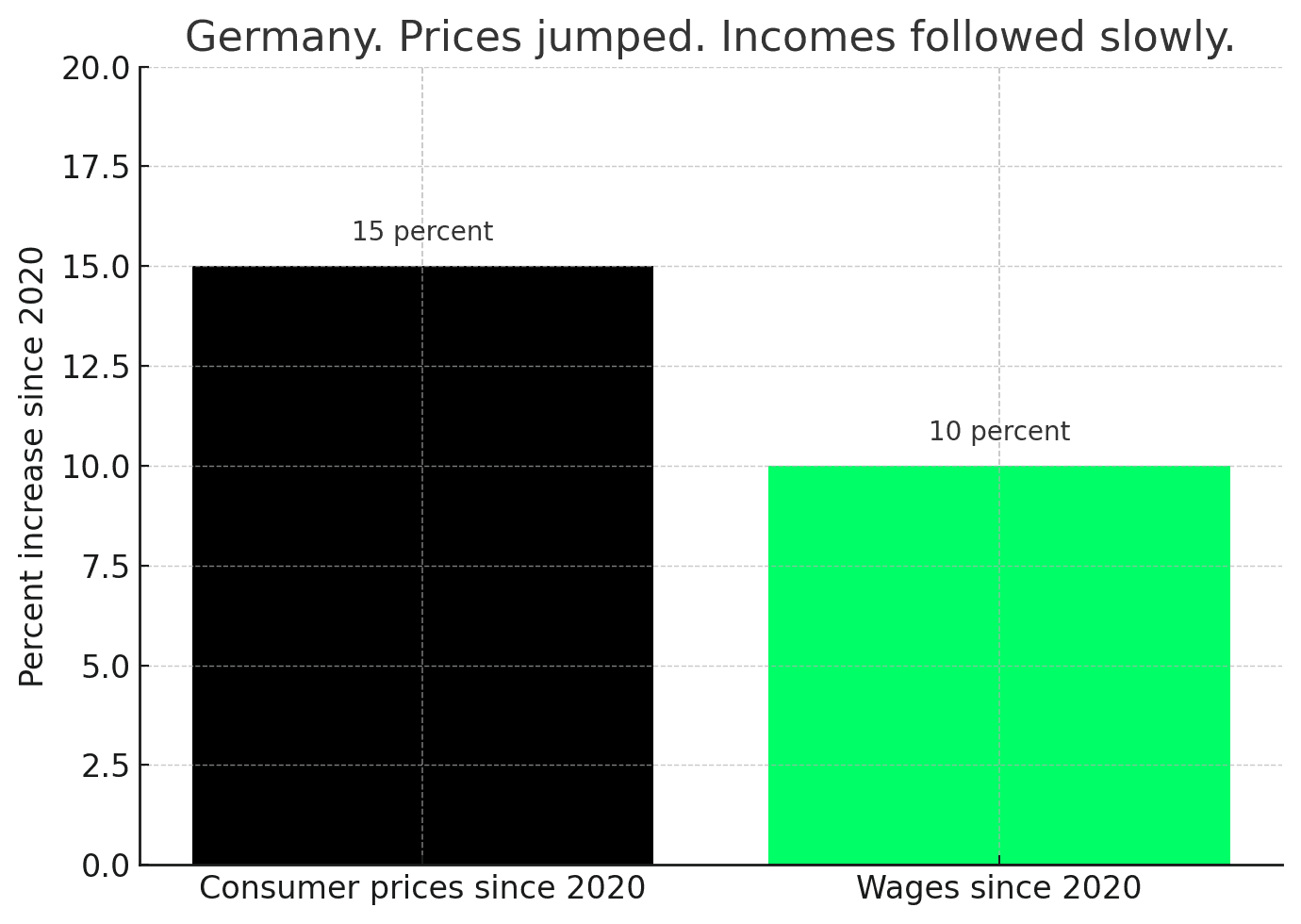

Prices are no longer rising as fast as before, but many goods and services remain far more expensive than they were a few years ago. What used to cost 100 euro in 2020 can cost about 115 euro today. The average paycheck only reached around 110 euro. That missing five euro is why many feel squeezed. Even if inflation slows, the higher level stays and continues to take more out of your budget each month.

Prices climbed faster than wages in Germany

People notice this every time they shop or pay rent. Groceries take a bigger share of income. Energy and housing remain costly. Many households save less than before because essential spending uses more of their income every month.

Why it has not gone away

Several ongoing pressures influence today's price increases. Energy and housing remain expensive and account for a large share of everyday spending. Companies in many countries face higher wages and operating costs, which they often pass on to consumers.

Geopolitical tensions affect trade and transport, so goods cost more to move and insure. Central banks raised interest rates to slow price growth, which helped, yet also reduced economic momentum.

Many people still feel that their income does not stretch as far as it used to. Higher living costs have reduced savings built up in recent years.

Governments and economists expect only modest growth, which means careful planning is more critical than ever to protect the value of your money.

How to reduce the impact

Older generations often benefit from earlier investments that grew over time. The rest of us can take action too. These steps help your money hold its ground.

• Bitcoin protects purchasing power. Its supply is fixed, and no central authority can create more. A portion of your savings in Bitcoin can act as a long-term shield when currencies lose value.

• Stocks give access to company growth. When businesses grow their profits, shareholders can benefit. Stocks help your savings participate in real economic activity instead of sitting still.

• Pay down debt. Debt can hurt during inflation, especially if your interest rate is adjustable. The amount you owe can rise while the value of your money falls, which makes payments more expensive.

Do not wait for prices to fall back

The rise happened. It stayed. It still reduces what you can afford each month. You worked hard for your money. Make sure it keeps working for you.

Start protecting your savings today.